Home » 2009 (Page 55)

Yearly Archives: 2009

Can You Believe It? Even The IRS is Using YouTube, iTunes

The IRS has launched a YouTube video site and an iTunes podcast site to better serve taxpayers.

People can visit the video site at www.youtube.com/irsvideos to view information about the Recovery, tax tips and how-to videos. These videos will be in English, Spanish, American Sign Language and other languages.

The YouTube focus will be on the provisions of the American Recovery and Reinvestment Act. Videos will highlight the $8,000 first-time homebuyer’s credit for those who purchase a house this year, the sales or excise tax deduction on new car purchases and the expanded credits for education and energy conservation.

The IRS YouTube channel will debut with seven Recovery videos in English and ASL and eight in Spanish. Also, included will be a video on using the IRS Withholding Calculator. Many workers received the Making Work Pay tax credit in April through their tax withholding at work. However, people who have more than one job or working spouses should especially check their withholding to ensure neither too much nor too little is being withheld. People can use the calculator to help determine if they should make adjustments.

People can visit the audio site at iTunes to listen to IRS podcasts about ARRA tax credits. People without an iTunes account can hear those same podcasts, in English and Spanish, on IRS.gov’s Multimedia Center.

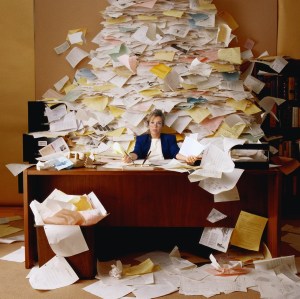

How to Keep Good Records

Although most people won’t be filing their tax returns for several months, the dog days of summer are actually a great time to start planning for the tax filing season by ensuring your records are organized. Whether you are an individual taxpayer or a business owner, you can avoid headaches at tax time with good records because they will help you remember transactions you made during the year.

Here are a few things the IRS wants you to know about recordkeeping.

Keeping well-organized records also ensures you can answer questions if your return is selected for examination or prepare a response if you are billed for additional tax. In most cases, the IRS does not require you to keep records in any special manner. Generally speaking, you should keep any and all documents that may have an impact on your federal tax return.

Individual taxpayers should usually keep the following records supporting items on their tax returns for at least three years:

Bills

Credit card and other receipts

Invoices

Mileage logs

Canceled, imaged or substitute checks or any other proof of payment

Any other records to support deductions or credits you claim on your return

You should normally keep records relating to property until at least three years after you sell or otherwise dispose of the property. Examples include:

A home purchase or improvement

Stocks and other investments

Individual Retirement Arrangement transactions

Rental property records

If you are a small business owner, you must keep all your employment tax records for at least four years after the tax becomes due or is paid, whichever is later. Examples of important documents business owners should keep Include:

Gross receipts: Cash register tapes, bank deposit slips, receipt books, invoices, credit card charge slips and Forms 1099-MISC

Proof of purchases: Canceled checks, cash register tape receipts, credit card sales slips and invoices

Expense documents: Canceled checks, cash register tapes, account statements, credit card sales slips, invoices and petty cash slips for small cash payments

Documents to verify your assets: Purchase and sales invoices, real estate closing statements and canceled checks

For more information about recordkeeping, check out IRS Publications 552, Recordkeeping for Individuals, 583, Starting a Business and Keeping Records, and Publication 463, Travel, Entertainment, Gift, and Car Expenses. These publications are available on the IRS Web site, IRS.gov or by calling 800-TAX-FORM (800-829-3676).

Links:

IRS Publication 552, Recordkeeping for Individuals (PDF)

IRS Publication 583, Starting a Business and Keeping Records (PDF)

IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses (PDF)